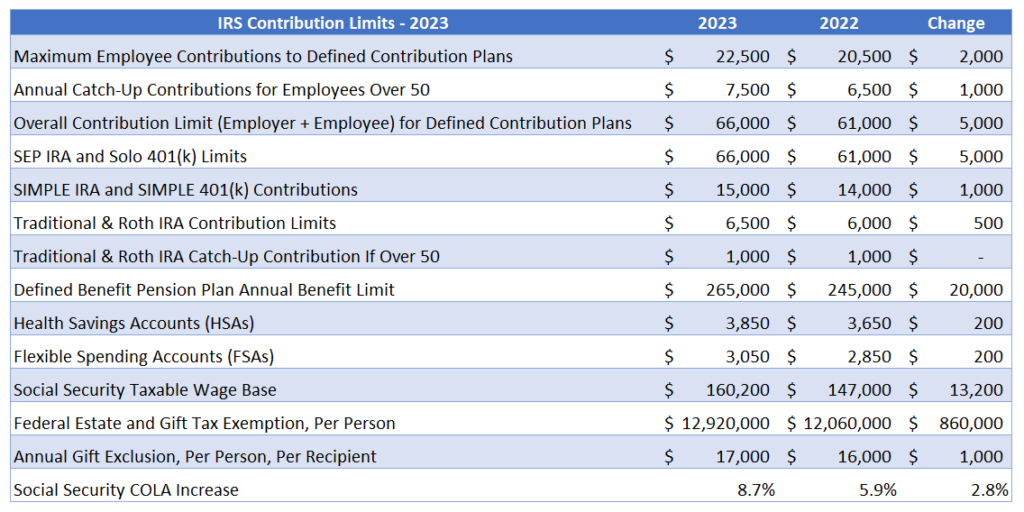

Traditional Ira Limits 2025. In 2025, you can contribute up to $7,000 to a traditional ira, a roth ira, or a combination of the two. 2025 traditional ira deduction limits.

In this issue, we provide the agi limits for 2025 and 2025. The maximum amount anyone can contribute to an ira (traditional and/or roth) for 2025 is $7,000.

Traditional Ira Limit 2025 Lotte Joycelin, The contribution limits for a traditional or roth ira increased last year but remain steady for 2025.

401k Roth Ira Contribution Limits 2025 Mary Anderson, In this issue, we provide the agi limits for 2025 and 2025.

Traditional Ira Limits 2025 2025 Donna Dowd, The contribution limits for 2025 are the same as those for 2025.

Roth Ira Limits 2025 Mfj Claire Paige, The ira contribution limit is $7,000, or $8,000 for individuals 50 or older in 2025 and 2025.

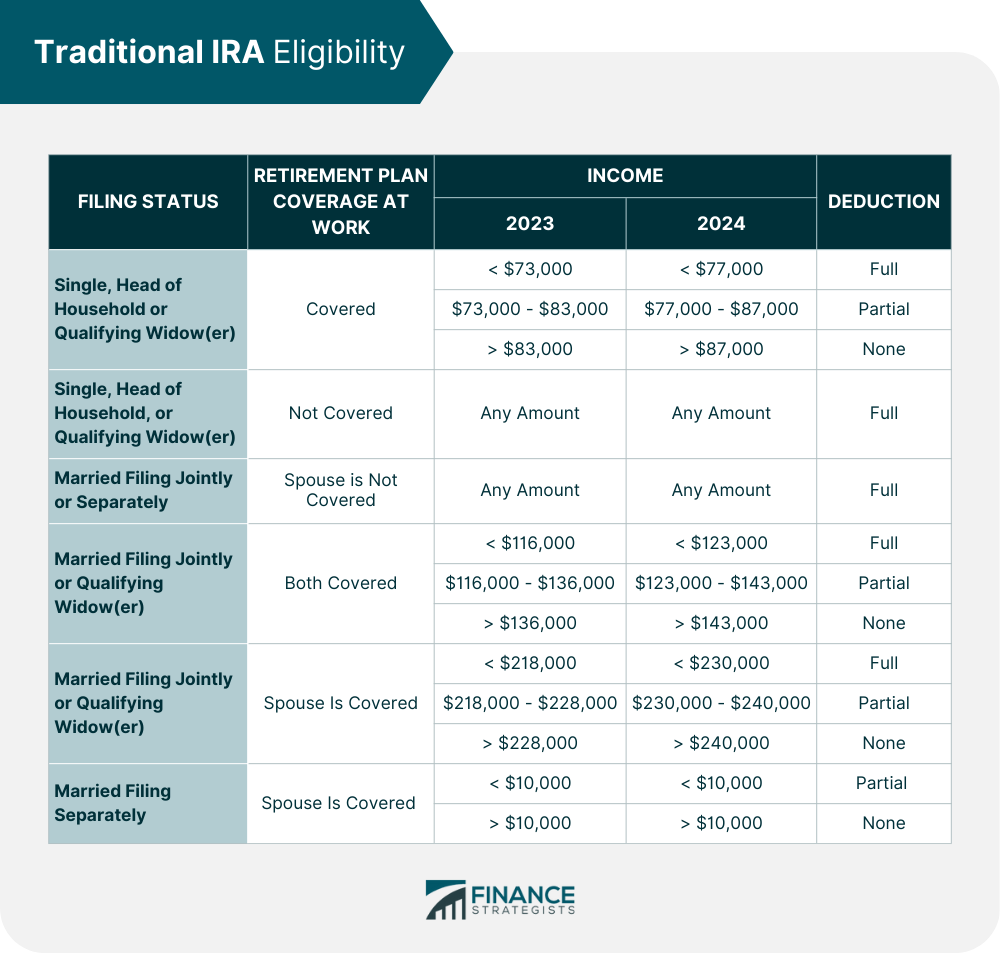

Roth Ira Limits 2025 Tax Sue Burgess, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based.

Roth Ira Contribution Limits 2025 Capital Gains Elizabeth Young, Ira limits aren't changing in 2025 currently, ira contributions max out at $7,000 for workers under the age of 50 and $8,000 for those 50 or older.

Traditional Ira Contribution Limit 2025 Jolyn Madonna, In 2025, you can contribute up to $7,000 to a traditional ira, a roth ira, or a combination of the two.

Ira Limits 2025 Married Joshua Hutton, Anyone can contribute to a traditional ira, but your ability to deduct contributions is based.

Roth Ira 2025 Contribution Limit Irs Ulla Alexina, The irs announced the 2025 limits for iras on nov.